Artificial Intelligence (AI) is no longer just a futuristic concept — it’s transforming how people manage money today. From budgeting to investing, AI tools are making personal finance smarter, faster, and more accessible.

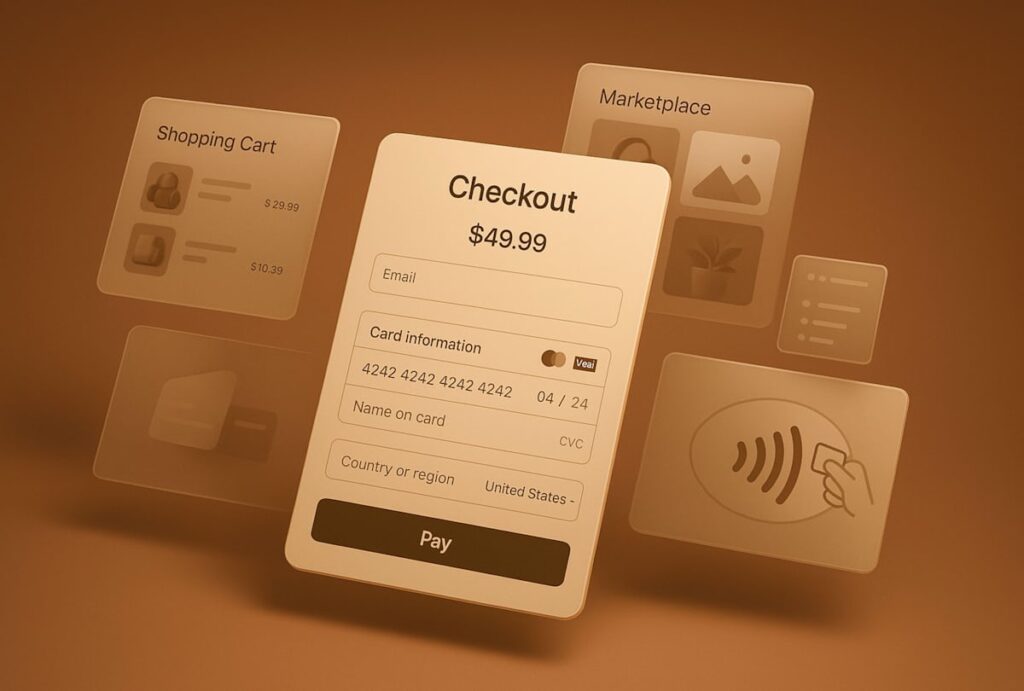

🔹 Smart Budgeting Apps

Modern apps now analyze your spending patterns automatically and provide personalized advice. They alert you about unnecessary expenses, suggest savings, and even forecast future spending based on your habits.🔹

AI-Driven Investment

PlatformsPlatforms powered by AI can monitor global markets in real time, identify profitable investment opportunities, and create portfolios tailored to your risk profile. Even beginners can invest confidently with algorithmic guidance.

🔹 Fraud Detection & Security

AI helps banks and fintech apps detect suspicious transactions instantly, reducing fraud risk and keeping your money safer than ever.🔹

Chatbots & Financial Advice

AI-powered chatbots provide instant answers to financial questions, helping users make informed decisions without waiting for human advisors.

🔹 Why It Matters

AI is democratizing finance. You no longer need advanced knowledge to manage investments, track spending, or plan for the future — technology does the heavy lifting.Bottom Line: AI in personal finance isn’t optional — it’s the future. Integrating these tools can save money, reduce risk, and make financial planning effortless.

Helping you stay informed, updated, and ahead in tech.